What is ABSD? How to avoid it legally?

Fourth Bukit Timah, Leasehold Condominium

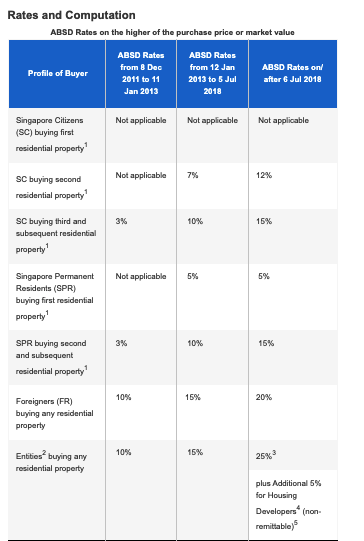

ABSD is Additional Buyer Stamp Duty. Introduced on 8th December 2011. It is one of the cooling measures to curb the over heated property market.

ABSD charge on the second and next property you buy. The extra stamp duty applies to all. Singaporean, Singapore Permanent Residence in Singapore and foreigners.

The properties include all kinds of residential property. Such as HDB flats, residential shophouses, condos and landed properties. It does not include commercial shophouses, commercial or industries properties.

Are you affected with the above scheme?

The following are examples when you need to pay for the ABSD.

1. If you are Singaporean buying your 2nd or next residential properties.

This apply to FTA(Free Trade Agreement) nations. They are nationals and PR of Iceland, Liechtenstein, Norway or Switzerland, and Nationals of the United States of America.

ABSD Rate

Purchase of 1st property No ABSD

Purchase of 2nd property 12%

Purchase of 3rd or subsequent property 15%

2. If you are Singapore PR who are buying the first and next residential property.

If you are Singapore PR

ABSD Rate

Purchase of 1st property 5%

Purchase of 2nd or subsequent property 15%

3. If you foreigners wanting to buy any residential property. Exclude those who are under FTA (Free Trade Agreement) nationality.

Foreigners will pay a flat rate of 20% ABSD. Regardless the number of property they buy in Singapore. Which means the first property in Singapore will be 20%. Like wise the subsequent purchase.

A flat 20% for every property they buy in Singapore.

4. If you are an entity (eg. Company or association). An entity means a person who is not an individual. It includes the following:

a. An unincoporated association

b. A trustee for a collective investment scheme when acting in that capacity

c. A trustee manager for a business trust when acting in that capacity

d. The partners of partnership. Whether any of them is an individual. Where the property conveyed, transferred or assigned held as partnership property.

If the property is only purchased by buyers of different profiles. The profile with the higher ABSD rate will apply on the entire value purchased.

Entities will pay a flat rate of 25% for all property they purchase in Singapore. Which means their first and subsequent property buy will be 25% ABSD. It applies to every property they own in Singapore.

But you can apply for remission if you are upgrading your property. Meaning if you buy the “2nd property”. With the intention of selling the existing property that you are owning now

You can do that if you are a married couple and at least one of you is a Singaporean.

Note that you need to pay ABSD within 14 days of completing the sale when you purchase the 2nd property. You can apply for remission of the ABSD payment within six months of buying your 2nd property.

For example, you have a 2 bedroom condo and wanting to upgrade to a bigger condo because of the increasing members. You can buy the bigger condo, which is your “2nd property”. If you can sell your existing property within six months then you are qualify for the remission of ABSD. Also, bear in mind with the condition that you need to stay married to apply for remission of ABSD.

3 Bedroom of Fourth Ave Residences in Bukit Timah

3 Bedroom of Fourth Ave Residences in Bukit Timah.. Read more

Other examples without having to pay the ABSD

1. Decoupling (if cost doesn’t exceed ABSD)

2. Purchase under trust for cash rich

3. get a dual key unit

4. Buy a commercial property

Collection of Bukit Timah Condo. Up to 200K Saving

Collection of Bukit Timah Condo. Up to 200K Saving